Failure to Break $71,800 Keeps Downside Risk Alive

Bitcoin Price Weekly Outlook

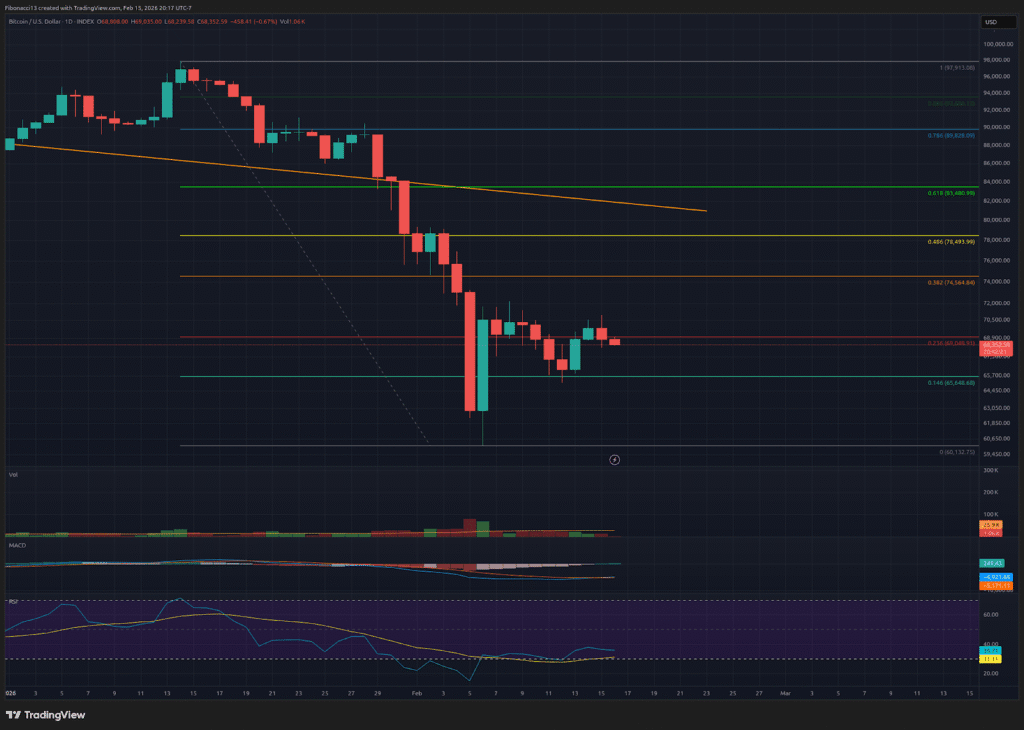

Last week’s price action has been bearish for Bitcoin. After seeing a big breakout from $60,000, the price failed to get above the temporary resistance at $71,800 last week. Instead, the price tested temporary support at $65,650 before pulling back to close the week at $68,811. While the weekly chart shows some buying power below $66,000, the lack of follow-through buyers on the bounces so far is a sign of weakness. Look for the price to rise to the lows of $60,000 this week if the bulls can sustain above $71,000 on a daily basis to challenge the highs.

Important Support and Resistance Levels Now

Last week, $65,650 proved to be a valid short-term support as the price dropped below it before quickly returning above it. If the day closes below $65,650, look for $63,000 to act as support. Below $63,000, we have a Fibonacci retracement of 0.618 at $57,800. This is a key level to hold as there is not much support below until $44,000.

If the bulls can gather some strength, resistance remains at $71,800. A close above this level leads to $74,500, with resistance at $79,000 above here. If the bulls somehow manage to get above $79,000 (unlikely), $84,000 remains a strong barrier to the upside.

This week’s Outlook

This week’s vision is hard to call. US markets are closed on Monday, so don’t expect much movement until Tuesday morning. We can really go either way from this close of $68,800. I would look for the $67,000 level to be tested earlier this week, and if we see support near there, we could move to $71,000 later in the week. If $67,000 is lost, however, look for the low $60,000 to be challenged again.

Market situation: Very bearish – The price could not gain any higher momentum last week at all. The bears are in full control.

Over the next few weeks

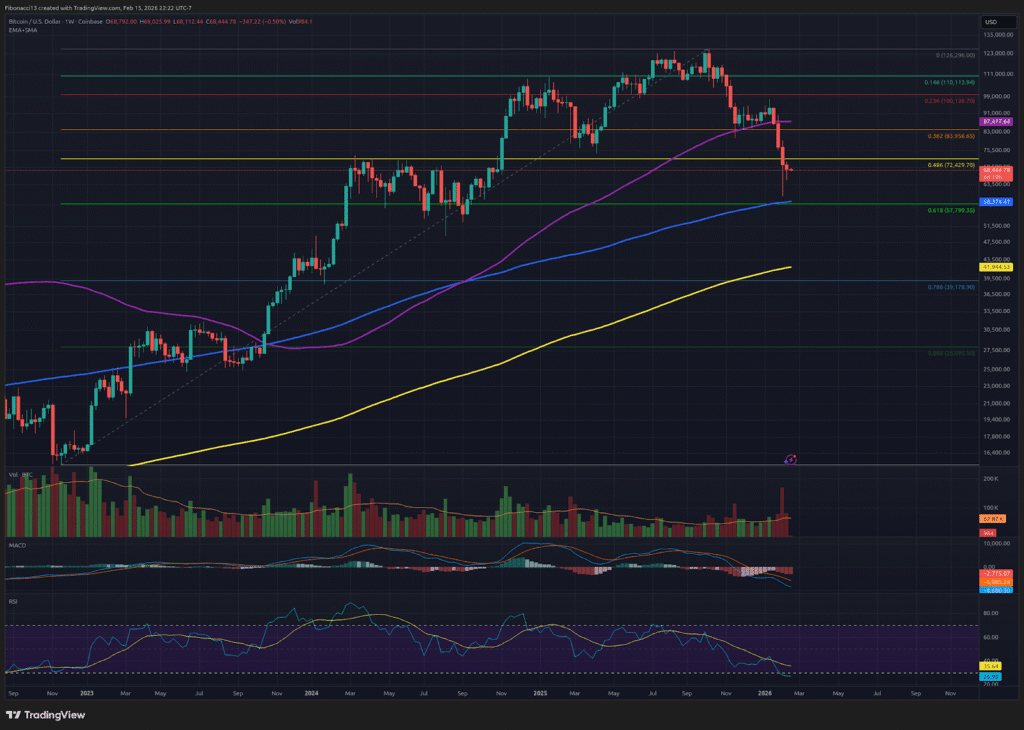

As I said last week, the price may move in the area from $ 60,000 to $ 80,000 for a while, maybe a wick down to the 0.618 Fibonacci retracement at $ 57,800. Currently, this ceiling can be lowered to $74.5k. There is no specific word on when the upcoming “Crypto Bill” will be passed by Congress, or what it will include in the crypto space as a whole. It is not guaranteed that it will lead to higher bitcoin prices when it finally passes, or, therefore, for now, we have to rely on technology to guide us. At the moment, the bias is still there, and if we lose $ 57,800, the price of bitcoin will probably take the next leg down.

Vocabulary Guide:

Bulls/Bulls: Buyers or investors do not expect the price to rise.

Bears/Bears: Sellers or investors are not expecting the price to go down.

Level of support or support: The level at which the price should hold for the asset, at least initially. The more support is touched, the weaker it is and the more likely it is to fail to hold the price.

Resistance or resistance level: As opposed to support. The rate is likely to decline the price, at least initially. The more resistance is touched, the weaker it is and the more likely it is to fail to hold the price.

Fibonacci Retracements and Extensions: Measurements based on what is known as the golden ratio, an international standard relating to the growth and decay cycles of nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).